To have a safe and functional internet, we need platforms to take real responsibility for stemming crime. That shouldn’t be a controversial statement in 2022, especially in the face of the pile-up of illegal and nefarious activities they facilitate.

If you need just one more example, though, then look no further than the swirl around Non-Fungible Tokens (NFTs).

As we wrote recently, thieves have been copying and selling art as unauthorized NFTs. Marketplaces have little incentive to fix the problem. In fact, OpenSea gets a cut from infringing transactions.

OpenSea can’t or won’t even help their own customers – the fanboys who want to trade in NFTs. Like other platforms that have pursued hypergrowth (ahem, ahem, YouTube), NFT marketplaces are arguably designed for scams and piracy.

Let’s review some cautionary tales, shall we?

Bored Apes for Ransom

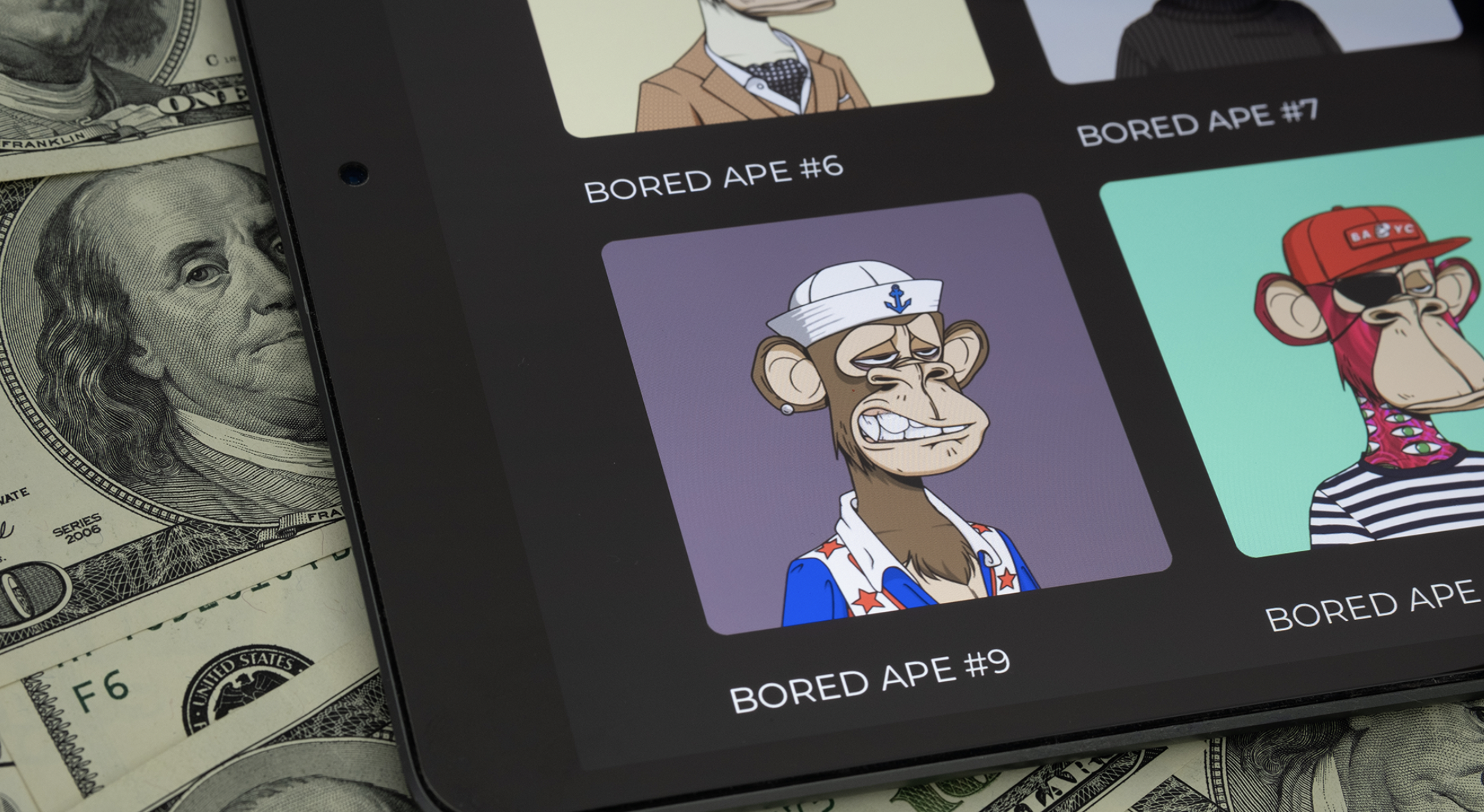

Meet members of the Bored Ape Yacht Club (BAYC). We’re talking about the cartoon creatures – not their sometimes-anonymous buyers. The BAYC includes 10,000 apes, making stupid faces and sporting silly clothes. If you buy one, you don’t just add it to your crypto wallet – you also use it as an entry pass to a highly exclusive virtual-reality swamp tavern.

There, you can participate in truly innovative and creative activities – like vandalizing the bathroom. As the BAYC designers predicted, “We’re pretty sure it’s going to be full of dicks.” Great, more dicks – just what the internet needs.

Graffiti aside, there’s good money in ape abductions. Blockchain technology lets thieves get away with it, because it hasn’t been designed to comply with Know-Your-Customer (KYC) obligations that are already required for banks.

Calvin Becerra learned that the hard way on October 29, 2021, when scammers plucked three BAYC NFTs from his wide-open crypto wallet. While Becerra thought he was getting some helpful “troubleshooting” advice from some potential (anonymous) buyers, it turned out they fooled him into changing his settings so they could steal his NFTs. His gullibility cost him almost $1 million.

Desperate to retrieve his stolen apes, Becerra photographed a handwritten ransom note, minted it as an NFT, and transferred it to the thieves’ crypto wallet. Since NFT buyers and sellers can remain anonymous, Becerra decided this was the best way to contact them. “I Forgive You,” he titled the digital object. “Sell My Apes Back.”

Being the kind of “dicks” that BAYC attracts, the thieves responded by putting Becerra’s letter up for sale. The asking price was 100 units of ethereum, which equals over $300,000 at the time of this writing.

The letter’s listing was eventually reported and delisted, and Becerra did recover ownership of BAYC #9564, the sailor-capped cyborg he displays on Twitter, as well as pink bubblegum-chewer #2031 and blindfolded cigar-smoker #9985. Their transaction histories don’t indicate what Becerra paid for their return.

Others have fallen prey to similar schemes. Todd Kramer, a New York gallery owner, lost $2.2 million worth of Bored Apes and other NFTs in a phishing scam. (Hackers gained access to his account.) Transaction logs for all eight of Kramer’s Bored Apes seem to indicate that he eventually recovered them. But once again, we wonder what he paid to get his own property back.

Our final tale is a doozy. It’s not a case of ransom, but it really drives home the point that the problem is the code.

By December 31, 2021, the crypto community had found discrepancies between the Ethereum blockchain and OpenSea’s interface. The discrepancies enabled bad actors to buy NFTs – without the owners’ permission – at extremely low price points, then turn around and sell those same NFTs for a massive profit. The vulnerability was discussed on Twitter on January 12, 2022. After a $1 million heist on January 24, 2022, one expert said the issue might be described as either a “bug” or a “loophole.”

With almost a month of warnings before this heist, why didn’t OpenSea fix the discrepancies? Were they asleep at their keyboards? Or did they have zero interest in whether theft is happening on their platform because they’re making a sweet, sweet 2.5% take on every transaction?

OpenSea wants you to believe that it is doing its best, but don’t be fooled – they built their business around a new, unregulated technology that facilitates piracy, fraud, and other crimes. Because of the way that cryptocurrency works, anonymous criminals walk away with untold profits.

The Problem is the Code

The NFT marketplace has established a new frontier on the internet – a digital Wild West that features too little of the Good, and far too much of the Bad and the Ugly. OpenSea, in particular, has provided a playground for online criminals interested in stealing from creatives and NFT collectors.

Ironically, the problem with cryptocurrencies and blockchains isn’t that they follow no code – as software, they literally ARE code, after all. The problem is their code reflects a juvenile, cyberlibertarian fantasy of total freedom from regulation.

As long as people live by these codes of irresponsibility, Big Tech, as well as startups, will continue to reap enormous profits at the expense of artists, consumers, and the public. The U.S. economy is already losing at least $29.2 billion and 230,000 jobs to digital theft every year.

Unregulated NFT marketplaces point to a concerning future where digital misdeeds further suffocate creative livelihoods and more victims. Government attention is way overdue.

This article was first published on CreativeFuture